ad valorem tax florida ballot

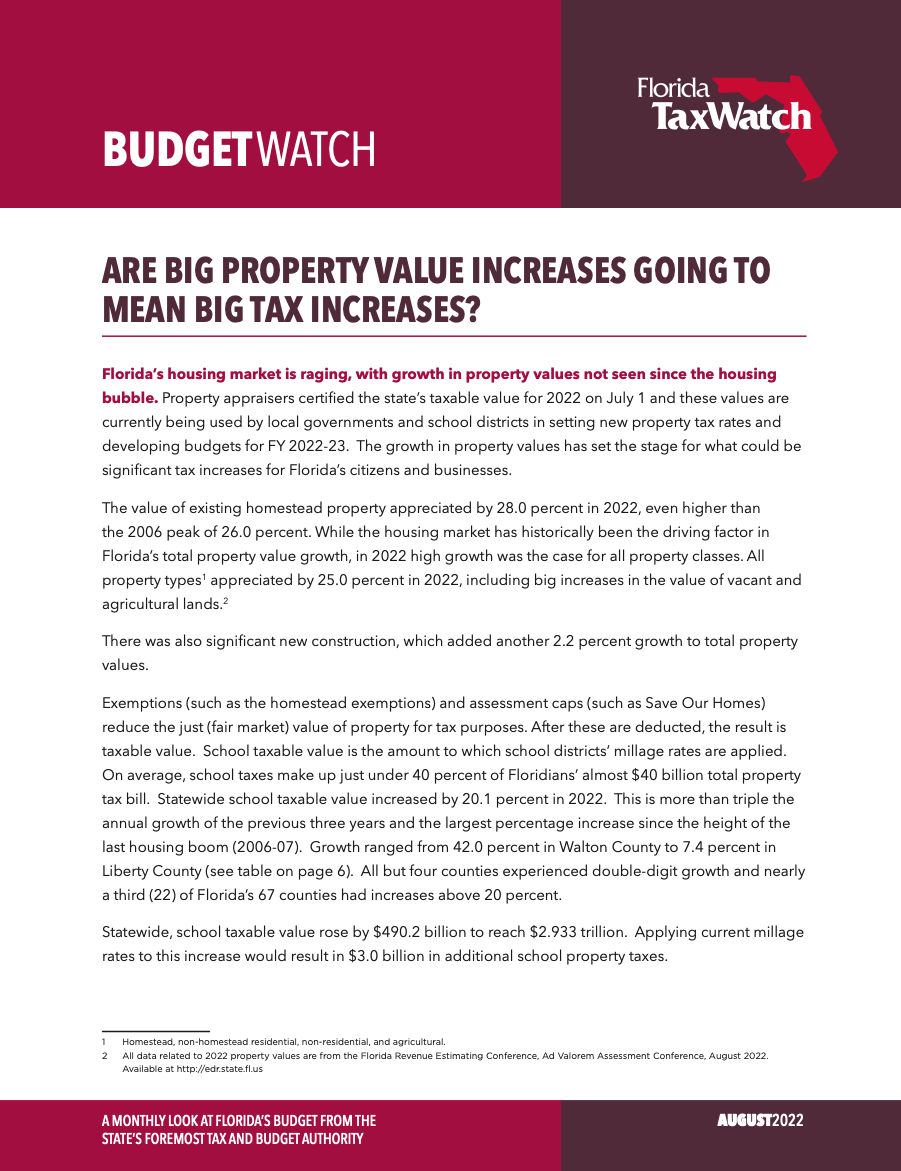

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. The Economic Development Ad Valorem Tax Exemption would allow the County to encourage the establishment of new businesses and the expansion of existing businesses by granting an.

Final Chance To Vote Early In Florida Primary

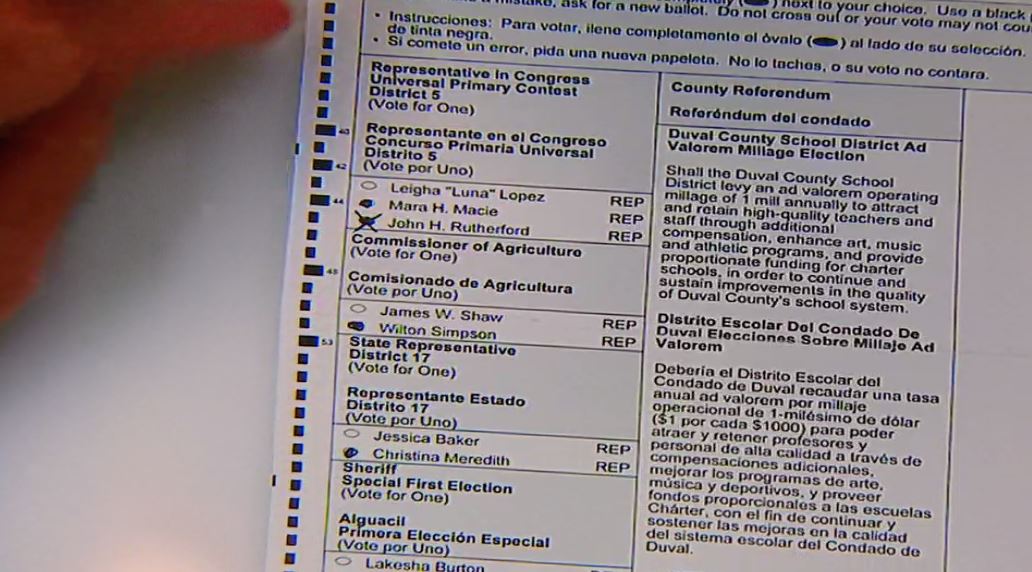

Shall the School Board of Orange County Florida continue the current one 1 mill ad valorem millage for.

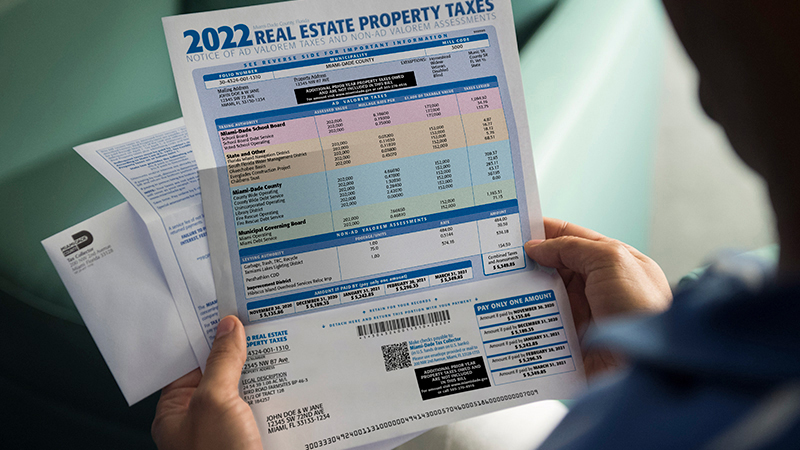

. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. The School Board of Hillsborough County wants to levy an additional tax of ad valorem operating millage of 1 mil annually one dollar of tax for each 1000 of assessment. Statistics for the 2022 General Election reported by.

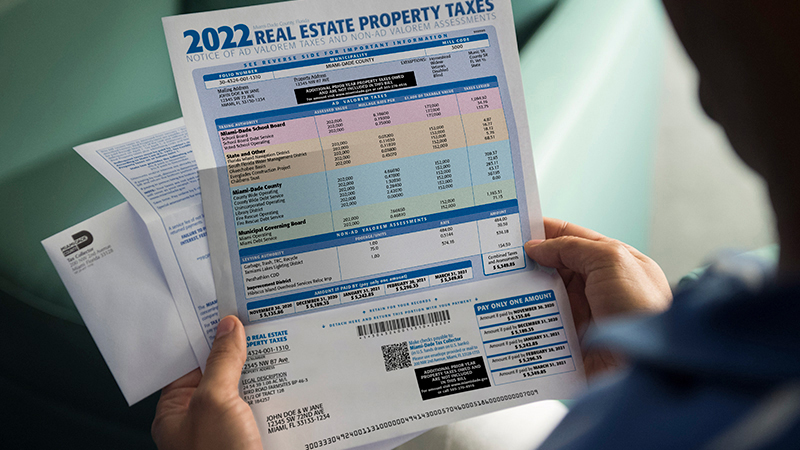

The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice a year. Further voters know they can trust the results because Florida has been a leader in election integrity and rapid results. A measure on the November ballot would require additional taxes of 1 per 1000 of taxable value of Brevard properties.

In August PTO releases the first publication which contains. Are what we pay for a civilized society. The Polk County Ad Valorem Tax Exemption Program AVTE is set to expire in November 2022 Malott explained.

The ballot title for this measure was as follows. Certainly this tax increase will add to Lake Countys civilized society The Lake County Democratic Party encourages the public to. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS.

A yes vote on this amendment would remove provisions that keep Palm Bays City Council from using ad valorem property taxes at a millage rate that caused the budgeted. The program was originally approved by County. On November 3 2020 City of Sarasota voters again passed a referendum that would extend the Economic Development Ad Valorem Tax Exemption EDAVTE program for ten years.

If enacted this measure would have. Authorized by Florida Statute. That would be 15310 more per year for the.

Are Big Property Value Increases Going To Mean Big Tax Increases

Liberty County Supervisor Of Elections Home

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

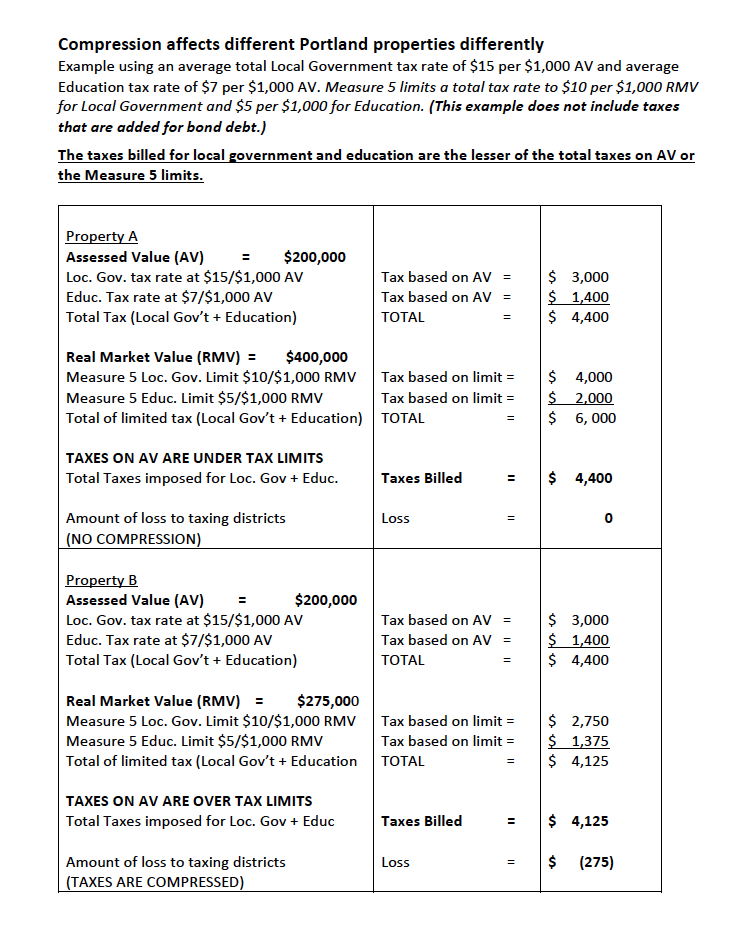

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Understanding Your Vote Naples Florida Weekly

Here Are The 3 Florida Amendments That Will Be On The Ballot This November

Miami Dade Democrats Recommendations For 2018 Ballot Amendments Miami Dade Democratic Party

The Constitutional Amendments On Florida General Election Ballots Explained

Marion County Election Preview See Local Florida Races On The Ballot

After Recount No Change In Hillsborough Schools Tax Results

Why Some States Are Moving To Restrict Ballot Initiatives Democracy Docket

Save On Your Property Tax Bill

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

2022 Elections Your Guide To The Local Races Across The Greater Tampa Bay Region Wusf Public Media

Amendment 2 Usa Today Network Florida Newspapers Recommendations